Gabriel FY 2024/25 analytiker video

Gabriel Holding

Gabriel FY2024/25 - Market-share gains and strong cash flow support positive re-rating

Gabriel Holding

GrønlandsBANKEN (One-pager): Fastholder helårsguidance efter Q2 2025

Grønlandsbanken

ISS (One-pager): Closing the valuation gap

ISS

Asetek (One-pager): Mid-term targets raised following major OEM returning customer

Asetek

Trifork - gennemgang af investeringscasen

Trifork Group

Danske Bank: Now expect a result in the upper end of the guidance range for 2025

Danske Bank

Trifork (one-pager): Triforks unikke forretningsmodel giver en sjælden investeringsmulighed

Trifork Group

Skjern Bank (One-pager): Solidt Q3 2025 efter opjustering af 2025-forventningerne tidligere i oktober

Skjern Bank

HCA Morgenbørs 22/9 - Flad åbning og fokus på fedmeaktier

Ørsted

Flügger extensive rapport: Analytiker video - Painting a profitable recovery

Flügger Group

Vestjysk Bank (One-pager): Fastholder 2025 forventningerne trods solidt H1 2025

Vestjysk Bank

Columbus (One-pager): Well-positioned when the market rebounds

Columbus

Aktier i Vælten - Novo Nordisk: Nu skal Magiske Mike levere

Novo Nordisk

Føroya Banki (One-pager): Ekstraordinært stærkt Q2 2025

Føroya Banki

Aktier i Vælten - Banksektoren: Den danske vindersektor år-til-dato

Danske Bank

Bankerne - foreløbig årets vindersektor

Danske Bank

Føroya Banki (One-pager): Opjustering efter solidt første halvår

Føroya Banki

Anbefalet

Selskabspræsentationer

Selskabsmeddelelser

Eksterne analyser

HCA Morgenbørs 08/12 - Små fald i futures og fokus på Gubra, Genmab og Lundbeck

Dagens aktienyheder 08/12-2025: Gubra og Hafnia

Bliv en del af Inderes community

Gå ikke glip af noget - opret en konto og få alle de mulige fordele

Inderes konto

Følgere og notifikationer om fulgte virksomheder

Analytikerkommentarer og anbefalinger

Værktøj til at sammenligne aktier og andre populære værktøjer

Sanoma reorganizes its financing

HCA Markedsoverblik november – Er FED klar til at lade julemanden besøge markederne

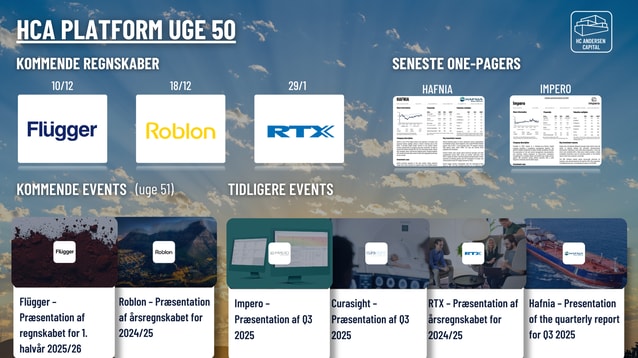

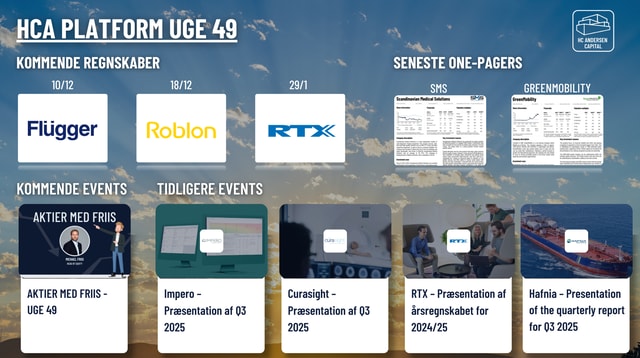

AKTIER MED FRIIS - UGE 49 2025

HCA Morgenbørs 05/12 - Overvejende positive futures-markeder hvor kun Japan er i minus

Enersense's financing arrangement received approval from noteholders

Dagens aktienyheder 05/12-2025: GreenMobility A/S

GreenMobility: What is the investment case in driverless cars

NYAB secures 35 MEUR railway contract in Mälardalen, Sweden

GreenMobility: How far away are driverless cars in Denmark

Dagens aktienyheder 04/12-2025: Vestjysk Bank og RTX

RTX - Video med præsentation af årsregnskabet for 2024/25

Norrhydro Group extensive report: Light at the end of the cylinder

HCA Morgenbørs 03/12 - Overvejende positive futures og fokus på ISS

Dagens aktienyheder 03/12-2025: Hafnia og ISS

HomeMaid acquires assets of Söndrums Hushållstjänster AB

Hafnia (One-pager): Ton mile increase lifts Q3 results as markets remain solid

eQ extensive report: Earnings turnaround approaching, eyes on new strategy

Seneste analyser

Norrhydro Group extensive report: Light at the end of the cylinder

Akkumulér

Norrhydro Group

03.12.2025

Hafnia (One-pager): Ton mile increase lifts Q3 results as markets remain solid

Hafnia

02.12.2025

eQ extensive report: Earnings turnaround approaching, eyes on new strategy

Reducer

eQ

02.12.2025

United Bankers: The sales machine is still undeperforming

Reducer

United Bankers

02.12.2025

Impero (One-pager): Improving SaaS metrics point to momentum ahead

Impero

01.12.2025

Trending

Decathlon extends its partnership with Bambuser to grow ‘Visio Store’, its interactive video service that connects customers directly with product advisors

28.05.2025 Pressemeddelelse

HCA Morgenbørs 01/12 - Rød start på december og fokus på Hafnia og kursmålsændringer

01.12.2025 Video

Dagens aktienyheder 02/12-2025: Vestjysk Bank, BioPorto A/S, ALK og Gubra

02.12.2025 Analytikerkommentar

Curasight – Præsentation af Q3 2025

24.11.2025 Videopræsentation

Novo Nordisk A/S: Oral semaglutide 50 mg achieved 15.1% weight loss (17.4% if all people adhered to treatment) in adults with obesity or overweight in the OASIS 1 trial

22.05.2023 Selskabsmeddelelse