HKFoods

1,3

EUR

-1,14 %

4.745 følger denne virksomhed

HKFOODS

NASDAQ Helsinki

Food & Beverage

Consumer Goods & Services

Overview

Finansielt overblik og estimater

Investor consensus

-1,14%

+4,84%

+26,83%

+68,39%

+53,66%

+84,14%

-0,46%

-36,59%

-93,56%

HKFoods operates in the food industry. Within the Group, there are a number of subsidiaries with the business of selling, marketing, and producing meat products of pig, beef, and poultry. The Group operates the entire value chain, from slaughter, cutting to processing and resale of the raw materials. HKFoods has the largest operations in the Nordic market. The head office is located in Turku.

Læs mereMarkedsværdi

116,88 mio. EUR

Aktieomsætning

26,98 t EUR

P/E (adj.) (25e)

29,16

EV/EBIT (adj.) (25e)

8,94

P/B (25e)

0,74

EV/S (25e)

0,27

Udbytteafkast, % (25e)

3,64 %

Omsætning og EBIT-margin

Omsætning mia.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

6.8

2025

Delårsrapport Q2'25

5.11

2025

Delårsrapport Q3'25

Risiko

Business risk

Valuation risk

Lav

Høj

Alle

Analyse

Selskabsmeddelelser

ViserAlle indholdstyper

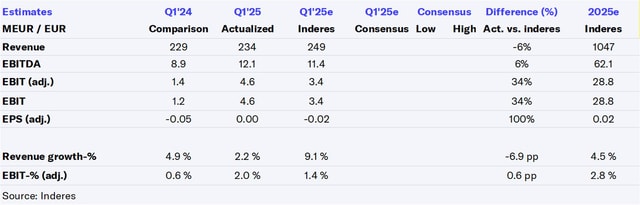

HKFoods Q1'25 flash comment: Earnings improved in a challenging market

HKFoods Plc's Interim Report Q1/2025: HKFoods' profitability grew clearly in January-March 2025

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

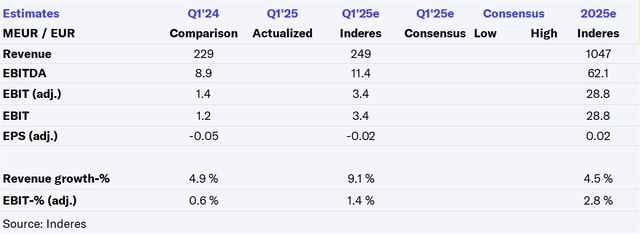

HKFoods Q1'25 preview: Efficiency-driven earnings growth continues

HKFoods: The sale of the Polish bacon unit could be enough to redeem the hybrid bond

HKFoods has launched the investigation to assess the future of its Polish bacon unit

Resolutions passed by the Annual General Meeting of HKFoods Plc and organization of the Board of Directors

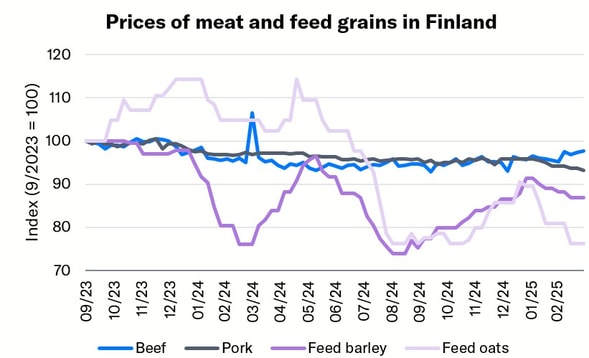

Atria and HKFoods: Meat prices and weak demand challenge earnings growth

Strikes are hitting the meat industry at a challenging time

HKFoods Plc's Annual Review 2024 has been published

HKFoods: Cancellation of treasury shares has no impact on our estimates

HKFoods Plc cancels treasury shares

Notice of the Annual General Meeting of HKFoods Plc

HKFoods: Slaughter capacity is reduced as market volumes decline

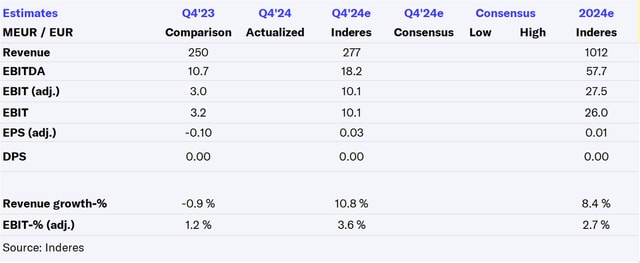

HKFoods Q4'24: Balance sheet risks prevail, even if result improves

HKFoods Q4'24 flash comment: Strong operating result was expected

Strong development continued in 2024; HKFoods showing clear growth in net sales and comparable EBIT