Metacon

0,181

SEK

+22,66 %

Mindre end 1K følgere

META

First North Stockholm

Industrial Goods & Services

Industrials

Overview

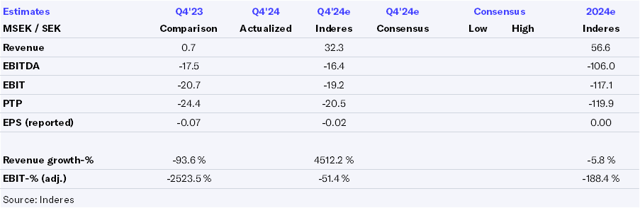

Finansielt overblik og estimater

Ownership

Investor consensus

+22,66%

+31,01%

+62,59%

+36,14%

-21,22%

+9,18%

-92,38%

-77,84%

-21,73%

Metacon is an energy technology company that develops and sells small and large energy systems for the production of hydrogen, electricity and heat. The company was founded in 2011 and has patented technology for the production of hydrogen gas from biogas or other hydrocarbons. The range consists, for example, of gas stations and larger CHP systems. The company has its headquarters in Örebro.

Læs mereMarkedsværdi

246,54 mio. SEK

Aktieomsætning

4,99 mio. SEK

P/E (adj.) (25e)

-3,68

EV/EBIT (adj.) (25e)

-4,68

P/B (25e)

3,61

EV/S (25e)

0,84

Udbytteafkast, % (25e)

-

Omsætning og EBIT-margin

Omsætning mio.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

21.5

2025

Delårsrapport Q1'25

27.5

2025

Generalforsamling '25

21.8

2025

Delårsrapport Q2'25

Risiko

Business risk

Valuation risk

Lav

Høj

Alle

Analyse

Selskabsmeddelelser

ViserAlle indholdstyper

Metacon strengthens cash position through exercise of warrants

Metacon AB: Metacon announces outcome in the exercise of warrants of series TO1 and resolves on directed issues to underwriters

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Metacon AB: Metacon completes the 50 MW hydrogen project contract with Motor Oil Hellas by closing agreement for additional 20 MW capacity

Metacon in final negotiations with a new customer

Metacon AB: Metacon informs about ongoing business negotiations

Metacon AB: The last day of trading with the warrants of series TO1

Metacon AB: Metacon via Pherousa receives initial Approval in Principle from ABS and DNV for Ammonia Cracking

Metacon AB: Correction of exercise price for warrants of series TO1

Metacon secures full subscription of TO1 warrants

Metacon AB: Metacon has received subscription intentions and entered into guarantee commitments regarding exercise of warrants of series TO1 and announces the exercise price for the warrants

Metacon: Another major order builds good momentum

Metacon AB: Metacon awarded an add-on contract for an additional 20 MW electrolysis plant from Motor Oil Hellas

Metacon signs supplementary agreement with PERIC

Metacon AB: Metacon has signed an add-on agreement for PERIC's pressurized alkaline stack technology for large electrolysers

Metacon Q4'24: Risk/reward profile has turned attractive

Metacon AB: Metacon publishes Year-end report for 2024