Sitowise Group

2,45

EUR

-0,81 %

2.399 følger denne virksomhed

SITOWS

NASDAQ Helsinki

Construction & Materials

Industrials

Overview

Finansielt overblik og estimater

Investor consensus

-0,81%

+2,06%

-0,41%

-19,67%

+8,41%

-15,22%

-59,17%

-

-70,15%

Sitowise Group operates in the construction and infrastructure industry. The company specializes in the development of major construction projects. Examples of projects that the company carries out, on its own and in collaboration with other companies in the industry, include road and building construction, as well as pipe and underground constructions. The largest operations are in the Nordic market, where customers are found among corporate customers and public actors.

Læs mereMarkedsværdi

87,82 mio. EUR

Aktieomsætning

1,55 t EUR

P/E (adj.) (25e)

34,16

EV/EBIT (adj.) (25e)

18,15

P/B (25e)

0,76

EV/S (25e)

0,85

Udbytteafkast, % (25e)

2,04 %

Coverage

Omsætning og EBIT-margin

Omsætning mio.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

13.8

2025

Delårsrapport Q2'25

6.11

2025

Delårsrapport Q3'25

Risiko

Business risk

Valuation risk

Lav

Høj

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

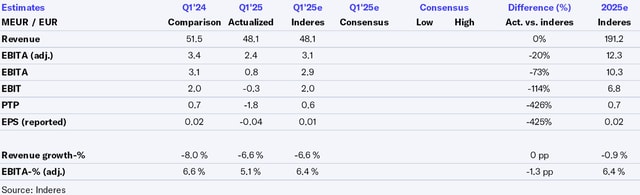

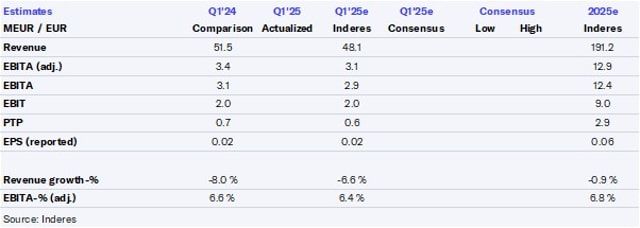

Sitowise Q1'25: We wait for clearer signals of a turnaround

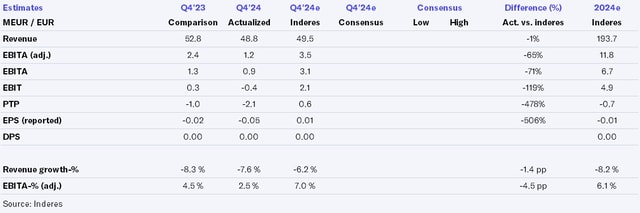

Sitowise Q1’25 flash comment: Revenue in line but earnings below expectations

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

CORRECTION: CFO Hanna Masala to leave Sitowise by the end of October

CFO Hanna Masala to leave Sitowise by the end of October

Sitowise's Interim Report Q1 2025: Improving underlying performance in Finnish operations

Sitowise Q1’25 preview: Market environment remains challenging

Sitowise: Decisions of the constitutive meeting of the Board of Directors

Decisions of the Annual General Meeting of Sitowise Group Plc

Change in Sitowise's Group Management Team

Notice to the Annual General Meeting of Sitowise Group Plc

Sitowise Group Plc's annual reporting package 2024 has been published

Sitowise secures new financing agreement

Inside information: Sitowise has signed a secured financing agreement as an extension of its current financing arrangement

Sitowise: Announcement of a Change in Shareholding According to Chapter 9, Section 10 of the Finnish Securities Market Act

Sitowise: Announcement of a Change in Shareholding According to Chapter 9, Section 10 of the Finnish Securities Market Act

Sitowise Q4'24: Negative earnings trend