Inderes

19,1

EUR

-1,04 %

3.698 følger denne virksomhed

INDERES

First North Finland

Software

Technology

Overview

Investor consensus

-1,04%

-1,29%

-2,8%

-4,02%

+0,26%

+1,87%

-57,22%

-

-56,53%

Inderes operates in the financial industry. The company provides a community platform for investors and listed companies. Via the platform, users can communicate with each other and exchange investment tips. The customers consist of both companies and private individuals. In addition, the company offers analysis services and a basis for investment decisions. The largest operations are in the Nordic region.

Læs mereMarkedsværdi

32,84 mio. EUR

Aktieomsætning

42,33 t EUR

Omsætning

18,39 mio.

EBIT %

6,42 %

P/E

73,46

Udbytteafkast, %

4,55 %

Coverage

Finanskalender

12.8

2025

Delårsrapport Q2'25

15.10

2025

Halvårligt udbytte

21.10

2025

Selskabsgennemgang Q3'25

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

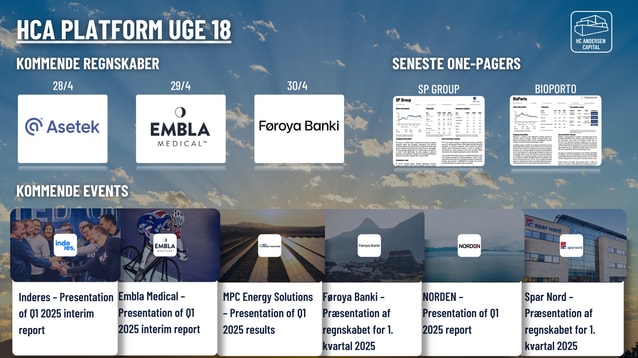

Dagens aktienyheder 28/04: BioPorto A/S, GreenMobility A/S, MapsPeople, Asetek og Inderes

Inderes Group - Headwinds in Sweden, but foundation is solid - SEB

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Inderes Group - Q1: In line report, but market outlook taking step back - SEB

Inderes’ Business review January–March 2025: 6% revenue growth in a volatile market

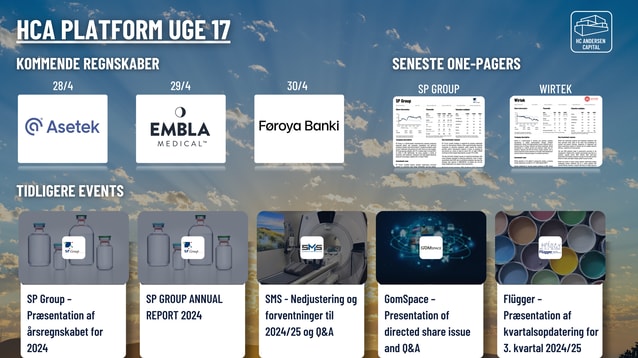

Dagens aktienyheder 23/04: GreenMobility A/S, Wirtek A/S, Inderes og Spar Nord

Inderes will publish its business review for January-March 2025 on 25 April 2025

Inderes' AGM 2025 | Board of Directors Q&A

Resolutions of Inderes Oyj's Annual General Meeting and the organizing meeting of the Board of Directors 2025

Inderes Group - The market is turning, but Sweden takes time - SEB

Inderes starts a new savings period in the employee share purchase program

Notice to Inderes Oyj’s Annual General Meeting 2025

Inderes’ revenue grew by 4% in January-February 2025

Inderes has concluded its share buyback programme

Inderes Oyj: Managers transactions – Mikael Rautanen

Inderes Oyj: SHARE REPURCHASE 7.2.2025

Inderes Oyj: SHARE REPURCHASE 6.2.2025

Inderes Oyj: SHARE REPURCHASE 5.2.2025