Penneo

Mindre end 1K følgere

Overview

Investor consensus

Penneo er en dansk Software-as-a-Service (SaaS)-virksomhed, der leverer løsninger til digital signering, dokument-workflow og compliance såsom et Know Your Customer-produkt (KYC), der hjælper virksomheder med at overholde anti-hvidvask-lovgivningen (AML). Penneo blev etableret i Danmark i 2014, og virksomheden har nu mere end 3.000 kunder i Danmark, Sverige, Norge, Finland og Belgien. Penneos primære kunder er revisorer, og virksomheden har ambitionen om at blive markedsleder og den foretrukne partner for revisions- og regnskabsbranchen i Europa. Penneo er noteret på Nasdaq Copenhagen Main Market.

Læs mereLatest research

Seneste analyse

Released: 30.08.2024

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

Eksterne analyser

ViserAlle indholdstyper

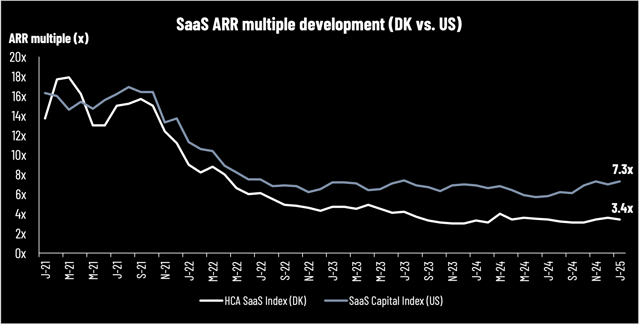

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

Penneo: Major Shareholder Announcement

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools