Agillic

8,65

DKK

AGILC

First North Denmark

Software

Technology

Agillic er en dansk Software as a Service (SaaS) virksomhed inden for marketingteknologi (MarTech), med hovedkontor i København, Danmark. Agillics omnichannel marketing automation platform giver brands mulighed for at arbejde med datadrevet indsigt og indhold for at skabe, automatisere og sende personlig kommunikation til millioner af personer. Beviste forretningscases findes inden for detailhandel, finans, turisme, energi og forsyning, teknologi og software, underholdning og spil, medier og forlag, velgørenhed og NGO og i abonnementsvirksomheder på tværs af alle brancher.

Læs mereLatest research

Seneste analyse

Released: 28.02.2025

Finanskalender

Delårsrapport Q2'25

Årsrapport '25

Generalforsamling '26

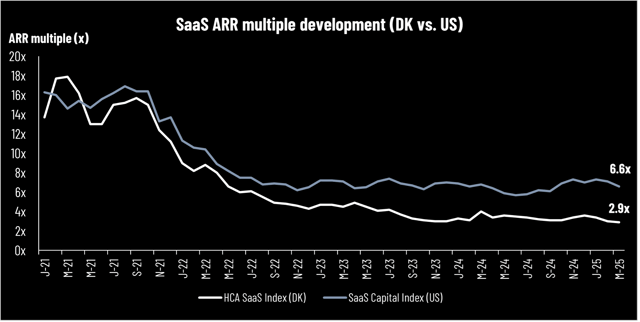

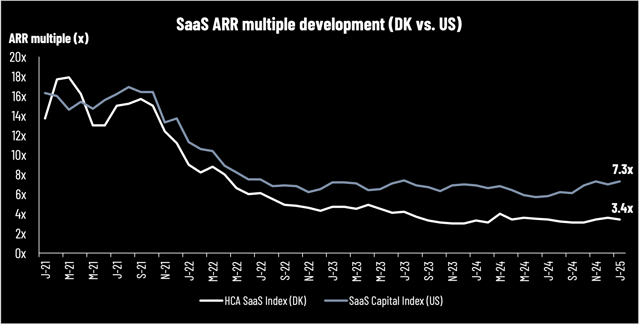

SaaS HCA update March 2025: Trend shows declining growth but improving profit

Grant of warrants

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Proceedings at the annual general meeting 2025

Dagens aktienyheder 01/04: Agillic, Audientes, Ascelia Pharma og Pharma Equity Group

Agillic appoints new CFO Jack Sørensen

Agillic appoints new CFO Jack Sørensen

Aller Media expands Agillic across the Nordics

Notice to annual general meeting in Agillic A/S

Dagens aktienyheder 28/02: Gubra, MPC Energy Solutions , Agillic, GreenMobility A/S, BioPorto A/S, og Roblon A/S.

Agillic (One-pager): Entering 2025 with a more focused strategy and earnings growth

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

Agillic - Recording of Q4 2024 presentation

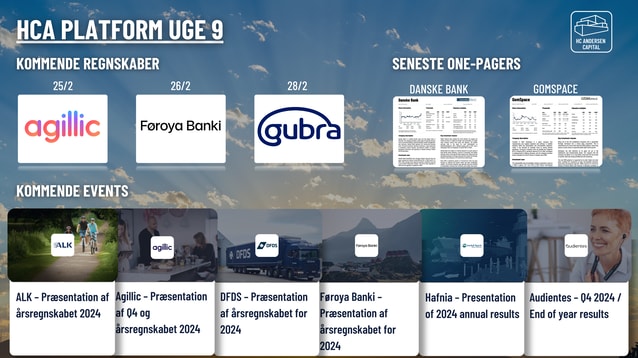

Agillic – Præsentation af Q4 og årsregnskabet 2024

Dagens aktienyheder 25/02: Skako, Agillic og ALK

Agillic publishes its annual results 2024 in line with preliminary results published on 6 February 2025

Sparekassen Kronjylland, number one in customer satisfaction, signs Agillic to raise the bar

Dagens aktienyheder 07/02: Danske Bank, Ascelia Pharma, Agillic, Mdundo, Skjern Bank og Gabriel