Biohit

2.52

EUR

-1.98 %

4,839 following

BIOBV

NASDAQ Helsinki

Medical Equipment & Services

Health Care

Overview

Financials & Estimates

Investor consensus

-1.98%

-12.8%

-24.78%

+10.04%

+7.23%

+22.93%

+61.54%

-6.32%

-51.54%

Biohit is a medical technology company. The company develops and manufactures laboratory equipment, supplies, and diagnostic analysis systems adapted for research, care, and industrial laboratories. In addition to the main activities, technical support, maintenance, and training services are offered within the mentioned work area. The largest presence is in the Nordic market. The company is headquartered in Helsinki.

Read moreMarket cap

38.27M EUR

Turnover

11.46K EUR

P/E (adj.) (25e)

16.8

EV/EBIT (adj.) (25e)

11.9

P/B (25e)

2.63

EV/S (25e)

1.77

Dividend yield-% (25e)

1.49 %

Coverage

Analyst

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

4.6

2025

General meeting '25

6.8

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

Publication of Biohit Oyj Annual Report 2024

Publication of Biohit Oyj Remuneration Report 2024

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Biohit Oyj - Managers' Transactions

Biohit: Safety margin available again

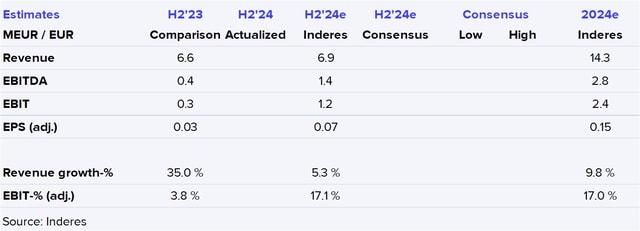

Biohit H2'24: Progress despite a bumpy road

BIOHIT GROUP FINANCIAL STATEMENT RELEASE 2024

Biohit H2’24 preview: Growth subdued in H2, but profitability excellent

BIOHIT and Restalyst announce collaboration to improve non-invasive early gastric cancer detection

BIOHIT introduces the FAEX™ Sample System for stool sample collection and handling

New distribution rights for Biohit

BIOHIT secures European distribution rights for Biomedal’s gluten immunogenic peptide tests

Biohit extensive report: Profitable growth through diagnostics

Biohit test receives further proof of its effectiveness in the UK

Approval of Biohit’s GastroPanel® test for use by the British National Health Service (NHS) takes a major step forward

Biohit: Performance surprised positively

Positive earnings surprise revealed under Biohit revenue guidance downgrade

Insider information, profit warning: Biohit lowers its guidance for 2024