Enento Group

16.7

EUR

+1.33 %

3,956 following

ENENTO

NASDAQ Helsinki

Software

Technology

Overview

Financials & Estimates

Investor consensus

+1.33%

+7.46%

-2.45%

-4.46%

-11.64%

-1.07%

-20.67%

-51.31%

+9.58%

Enento operates in the IT sector. Within the Group, there is specialist competence in the development of digital information services that concern risk management, decision-making, sales, and marketing. The vision is to offer programs and digital platforms that can also be used for the analysis of company data, routines, and decision-making processes. The company was previously known as Asiakastieto and is headquartered in Helsinki.

Read moreMarket cap

395.79M EUR

Turnover

32.02K EUR

P/E (adj.) (25e)

17.92

EV/EBIT (adj.) (25e)

13.25

P/B (25e)

1.54

EV/S (25e)

3.54

Dividend yield-% (25e)

5.99 %

Coverage

Analyst

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

15.7

2025

Interim report Q2'25

28.10

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

CEO Jeanette Jäger to leave Enento Group

Enento Q1'25: Return to growth

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Enento Q1’25: Rowing Through a Heavy Market

Enento, Webcast, Q1'25

Enento Group’s Interim Report 1.1. – 31.3.2025: Sales growth driven by good performance in Business Insight

Enento Q1'25 preview: Uncertainty is also reflected in the price

Enento Group will publish January-March interim report on 25 April 2025

Decisions taken by Enento Group Plc’s Annual General Meeting and Board of Directors

Enento Group’s Annual Report 2024 has been published

Enento Group Plc’s Notice to the Annual General Meeting

Enento Q4'24: Swedish market sets course for this year

Enento, Webcast, Q4'24

Enento Group's Financial Review 2024 and Remuneration Report 2024 have been published

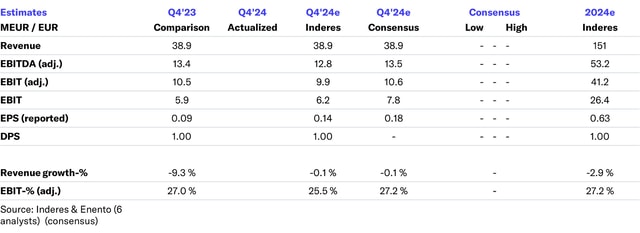

Enento Group’s Financial Statement release 1.1. – 31.12.2024: Business Insight growth and strong free cash flow highlight Enento Group’s resilience amidst the difficult consumer credit market