HKFoods

1.27

EUR

-1.17 %

4,747 following

HKFOODS

NASDAQ Helsinki

Food & Beverage

Consumer Goods & Services

Overview

Financials & Estimates

Investor consensus

-1.17%

+14.41%

+33.12%

+64.51%

+74.45%

+84.06%

-10.18%

-38.5%

-93.71%

HKFoods operates in the food industry. Within the Group, there are a number of subsidiaries with the business of selling, marketing, and producing meat products of pig, beef, and poultry. The Group operates the entire value chain, from slaughter, cutting to processing and resale of the raw materials. HKFoods has the largest operations in the Nordic market. The head office is located in Turku.

Read moreMarket cap

114.19M EUR

Turnover

37.23K EUR

P/E (adj.) (25e)

79.19

EV/EBIT (adj.) (25e)

9.56

P/B (25e)

0.63

EV/S (25e)

0.26

Dividend yield-% (25e)

-

Revenue and EBIT-%

Revenue B

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

23.4

2025

General meeting '25

24.4

2025

Annual dividend

7.5

2025

Interim report Q1'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

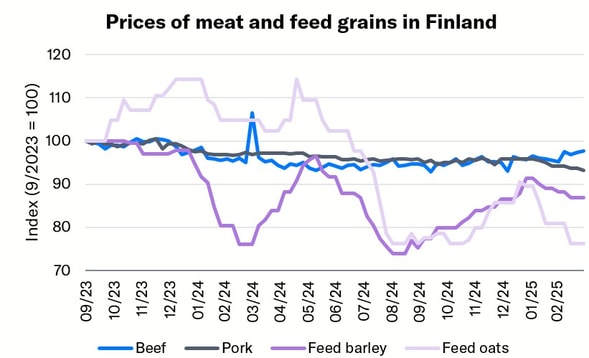

Strikes are hitting the meat industry at a challenging time

HKFoods Plc's Annual Review 2024 has been published

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

HKFoods: Cancellation of treasury shares has no impact on our estimates

HKFoods Plc cancels treasury shares

Notice of the Annual General Meeting of HKFoods Plc

HKFoods: Slaughter capacity is reduced as market volumes decline

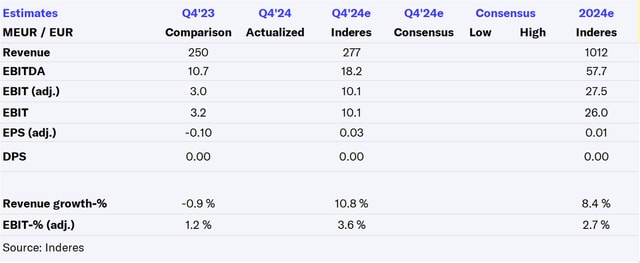

HKFoods Q4'24: Balance sheet risks prevail, even if result improves

HKFoods Q4'24 flash comment: Strong operating result was expected

Strong development continued in 2024; HKFoods showing clear growth in net sales and comparable EBIT