H&M

139

SEK

+0.25 %

3,695 following

HM B

NASDAQ Stockholm

Personal Goods

Consumer Goods & Services

Overview

Financials & Estimates

Ownership

Investor consensus

+0.25%

+3.69%

-6.21%

-6.77%

-21.27%

-17.01%

+7.75%

+8.21%

+5,878.49%

Hennes & Mauritz is a retail chain. The range consists of clothing, shoes, and accessories. The group also includes brands such as COS, Monki, Weekday, Cheap Monday, and Other Stories. Today, the company also conducts business in home furnishings via H&M Home. The company has a presence in all global regions. H&M was originally founded in 1947 and is headquartered in Stockholm, Sweden.

Read moreMarket cap

223.87B SEK

Turnover

214.37M SEK

P/E (adj.) (25e)

20.29

EV/EBIT (adj.) (25e)

17.5

P/B (25e)

4.82

EV/S (25e)

1.21

Dividend yield-% (25e)

5.4 %

Revenue and EBIT-%

Revenue B

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

7.5

2025

General meeting '25

8.5

2025

Half year dividend

26.6

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

Tariff headwinds raise concerns around margin pressure for H&M

H&M Q1'25: Gross margin more sluggish than expected

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

H & M Hennes & Mauritz AB: H&M's nomination committee proposes Klas Balkow as new board member

H & M Hennes & Mauritz AB: Notice of annual general meeting

H & M Hennes & Mauritz AB publishes its annual and sustainability report 2024

H & M Hennes & Mauritz AB Three-month report 2025

H&M Q1'25 preview: Risk/reward attractive despite slower recovery

H&M Q4'24: Risk/reward turns positive

H & M Hennes & Mauritz AB Full-year report 2024

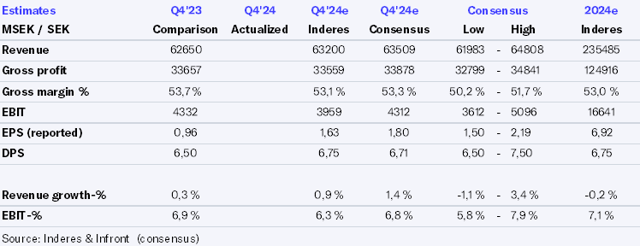

H&M Q4’24 preview: Margin headwinds persist in Q4