NYAB

5.31

SEK

+0.38 %

4,004 following

NYAB

First North Stockholm

Multi

Energy

Overview

Financials & Estimates

Ownership

Investor consensus

+0.38%

-7.65%

+5.78%

+6.84%

-7.33%

-2.63%

-54.08%

+56.11%

-86.43%

NYAB provides services of engineering, construction and maintenance with a focus on sustainable infrastructure and renewable energy. Offering includes, among others, roads, railways, bridges, airports, wind and solar power, as well as power networks. In addition, NYAB provides various types of facilities for industrial clients. NYAB operates in Sweden and Finland within both private and public sector.

Read moreMarket cap

3.79B SEK

Turnover

208.44K SEK

P/E (adj.) (25e)

13.99

EV/EBIT (adj.) (25e)

9.58

P/B (25e)

1.65

EV/S (25e)

0.66

Dividend yield-% (25e)

2.49 %

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

7.5

2025

Interim report Q1'25

13.8

2025

Interim report Q2'25

5.11

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

NYAB, Webcast, Q1'25

NYAB extensive report: Premium financials to an attractive price tag

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

NYAB AB: NYAB appoints Arve Jensen as member of the Executive Management Team

NYAB AB: NYAB signs contract for the first section of the North Bothnia Line in Umeå

NYAB AB: Notice to Annual General Meeting 2025

NYAB AB: NYAB publishes Annual and Sustainability Report 2024

NYAB AB: NYAB signs extensive contract for expansion of the port of Umeå

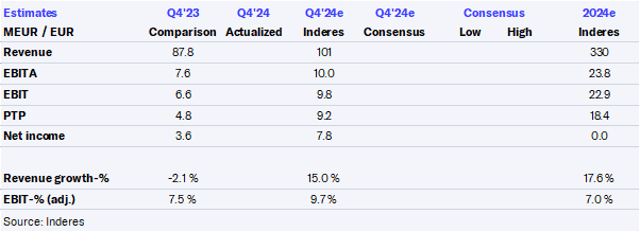

NYAB Q4'24: Strong execution across the board

NYAB Q4'24: Ending the year on a strong note

NYAB, Audiocast, Q4'24

NYAB AB: NYAB publishes pro forma financial information regarding the acquisition of businesses from Dovre Group

NYAB AB's Year-end Report 2024: Strong financial performance creates foundation for future growth