Puuilo

12.75

EUR

-2.15 %

6,784 following

PUUILO

NASDAQ Helsinki

Retailers

Consumer Goods & Services

Overview

Financials & Estimates

Investor consensus

-2.15%

+1.67%

+28.4%

+24.76%

+41.43%

+20.62%

+147.57%

-

+75.62%

Puuilo operates in the retail industry. The company operates and manages a number of stores and trading venues. The range is wide and includes items within domestic and pet animals that are forwarded under own or other brands. The customers mainly consist of private actors worldwide, and the largest presence is in Finland.

Read moreMarket cap

1.08B EUR

Turnover

997.67K EUR

P/E (adj.) (25e)

20.2

EV/EBIT (adj.) (25e)

16.3

P/B (25e)

11.26

EV/S (25e)

2.73

Dividend yield-% (25e)

3.96 %

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

10.6

2025

Business review Q1'25

11.9

2025

Interim report Q2'25

15.10

2025

Half year dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Resolutions of Puuilo Plc's Annual General Meeting and the constitutive meeting of the Board of Directors

CORRECTION: Puuilo Plc Notice to the Annual General Meeting 2025

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Puuilo’s Annual Reporting 2024 has been published

Puuilo Plc: Board Of Directors established a new long-term incentive plan for company's key employees

Puuilo Plc: Notice to the annual general meeting

Puuilo Oyj - Managers' Transactions (Ranta)

Puuilo Oyj - Managers' Transactions (Saarela)

Change In The Holding of Puuilo Plc’s treasury shares

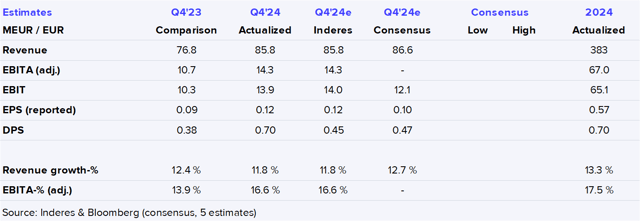

Puuilo Q4'24: Good momentum continues, but valuation is tight

Puuilo Q4'24 flash comment: Expected guidance, shareholders rewarded with an additional dividend

Puuilo Plc, Financial Statements Release 2024: Record Year – net sales and EBITA continued to grow

Puuilo has signed a new € 100 million long-term financing agreement

Proposal of the Shareholders’ Nomination Board for the composition and remuneration of Puuilo’s Board of Directors

Puuilo Plc will publish its Financial statements release for the financial year 2024 on 27 March 2025

Tokmanni’s competitor Rusta grew strongly in its domestic market in Sweden