Sitowise Group

2.27

EUR

-3.79 %

2,393 following

SITOWS

NASDAQ Helsinki

Construction & Materials

Industrials

Overview

Financials & Estimates

Investor consensus

-3.79%

-8.84%

-21.45%

-25.57%

-19.22%

-18.93%

-63.97%

-

-72.34%

Sitowise Group operates in the construction and infrastructure industry. The company specializes in the development of major construction projects. Examples of projects that the company carries out, on its own and in collaboration with other companies in the industry, include road and building construction, as well as pipe and underground constructions. The largest operations are in the Nordic market, where customers are found among corporate customers and public actors.

Read moreMarket cap

81.37M EUR

Turnover

834.68 EUR

P/E (adj.) (25e)

29.21

EV/EBIT (adj.) (25e)

16.24

P/B (25e)

0.69

EV/S (25e)

0.81

Dividend yield-% (25e)

4.41 %

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

13.5

2025

Interim report Q1'25

13.8

2025

Interim report Q2'25

6.11

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Decisions of the Annual General Meeting of Sitowise Group Plc

Change in Sitowise's Group Management Team

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Notice to the Annual General Meeting of Sitowise Group Plc

Sitowise Group Plc's annual reporting package 2024 has been published

Sitowise secures new financing agreement

Inside information: Sitowise has signed a secured financing agreement as an extension of its current financing arrangement

Sitowise: Announcement of a Change in Shareholding According to Chapter 9, Section 10 of the Finnish Securities Market Act

Sitowise: Announcement of a Change in Shareholding According to Chapter 9, Section 10 of the Finnish Securities Market Act

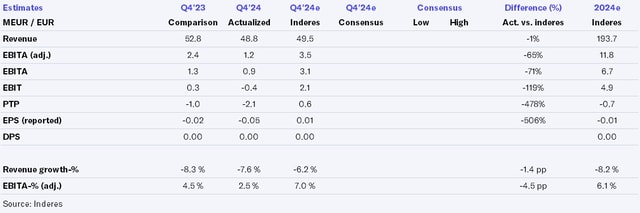

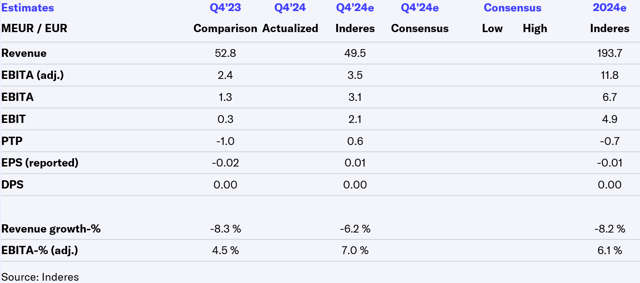

Sitowise Q4'24: Negative earnings trend

Sitowise Q4'24 flash comment: Poor result and lack of guidance point to challenges

The Board of Directors of Sitowise has decided on new share plans

Sitowise Financial Statement Release 2024: Finishing the year with strong cash flow, actions to improve profitability will continue

Sitowise Q4'24 preview: Dependent on market turnaround

Proposals of the Shareholders' Nomination Board of Sitowise for the Annual General Meeting 2025

Sitowise Extensive Report: Waiting for proof of turnaround

Sitowise: Digital solutions bring growth and profitability