Solwers

2.21

EUR

+1.38 %

SOLWERS

First North Finland

Industrial Goods & Services

Industrials

Solwers is a consulting company focused on the industrial sector. The company specializes in digital solutions that concern planning and project management services. Examples of the company's services include architecture, technical consulting, environmental monitoring, project management, circular economy, and digital solutions. The customers are found in a number of industries and mainly among small and medium-sized corporate customers. Solwers operates worldwide with the largest presence in the Nordic region.

Read moreCoverage

Co. Head of Research

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

Business review Q1'25

Interim report Q2'25

Business review Q3'25

Risk

Solwers Oyj: Notice convening the Annual General Meeting of Solwers Plc

Solwers Oyj: Solwers Plc's Financial Reports and Remuneration Report for the Year 2024 Published

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Solwers' CEO will change by next spring

Solwers Oyj: Inside information: Solwers' CEO to change by spring 2026

Solwers Oyj: Proposals of Solwers Plc's Shareholders' Nomination Committee for the Annual General Meeting 2025

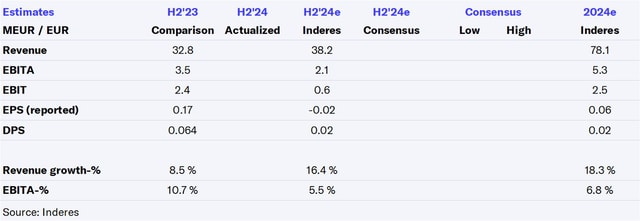

Solwers H2'24: Increased investment activity is key

Solwers, Webcast, Q4'24

Solwers Oyj: Financial Statements Release 1 January - 31 December, 2024

Solwers Q4'24 preview: With the profit warning, the overall picture of the result is clear

Kreate has filed a compensation claim against Solwers' subsidiary

Solwers Oyj: Inside Information: Solwers Plc's subsidiary Finnmap Infra Oy has received a compensation claim filed by Kreate Oy

Solwers Oyj: Publication of Solwers' Financial Statements 2024 Release and invitation to webcast

Solwers: Challenges have surfaced late in the year

Solwers Oyj: Inside Information: Solwers' IFRS EBIT at the end of 2024 lower than anticipated

Solwers Oyj: Solwers Plc's Financial Calendar and Annual General Meeting 2025

Solwers as an Investment | Company Night Dec. 16, 2024