Verve

33.36

SEK

-3.75 %

VER

First North Stockholm

Software

Technology

Verve (Ticker: VER) is a fast-growing, profitable, digital media company that provides AI-driven ad-software solutions. Verve matches global advertiser demand with publisher ad-supply, enhancing results through first-party data from its own content. Aligned with the mission, “Let’s make media better,” the company focuses on enabling better outcomes for brands, agencies, and publishers with responsible advertising solutions, with an emphasis on emerging media channels. Verve’s main operational presence is in North America and Europe. Its shares are listed on the Nasdaq First North Premier Growth Market in Stockholm and the Scale segment of the Frankfurt Stock Exchange. The company has three secured bonds listed on Nasdaq Stockholm and the Frankfurt Stock Exchange Open Market.

Read moreRevenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

Interim report Q1'25

General meeting '25

Interim report Q2'25

Risk

Verve Group SE Announces Publication of its 2024 Annual and Sustainability Report

Verve Group SE announces that the total number of shares of the company increases following the issuance of new shares to service parts of the employee stock option program

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Verve places new 500 MEUR bond and redeems existing bonds early

EQS-News: Verve Group SE Places €500M New Senior Unsecured Bonds and Announces Early Redemption of 2026 and 2027 Bonds - Driving Significant Interest Cost Reduction

Redeye: Verve Group - Strong momentum continues

Verve Q4'24: Strong execution all over

Verve Group, Audiocast with teleconference, Q4'24

Verve Achieves 46% Revenue and 53% Adjusted EBITDA Growth in Q4 2024, Strong Free Cashflow Reduces Leverage Ratio to 2.4x, Organic Revenue Growth of 24% in Q4’24

EQS-News: Verve Achieves 46% Revenue and 53% Adjusted EBITDA Growth in Q4 2024, Strong Free Cashflow Reduces Leverage Ratio to 2.4x, Organic Revenue Growth of 24% in Q4’24

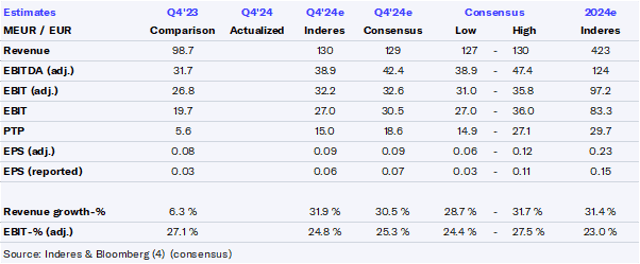

Modular Finance IR Consensus: Verve – Consensus estimates Q4 2024

Verve Group SE Invites Investors to the Presentation of its Year End Report Q4 2024 on February 27, 2025 at 10:00am CET

EQS-News: Verve Group SE Invites Investors to the Presentation of its Year End Report Q4 2024 on February 27, 2025 at 10:00am CET

Verve Q4’24 preview: Tougher comparison period will slow the organic growth in Q4

Verve Group SE announces that the total number of shares of the company increases following the issuance of new shares to service parts of the employee stock option program

Verve Group SE: Appointment of Nomination Committee

Redeye: Verve Group - Continues to gain market share

Verve Q3'24: The risk/reward just got more attractive