Hexagon

88.6

SEK

-1.53 %

Less than 1K followers

HEXA B

NASDAQ Stockholm

Hardware Manufacturer

Technology

Overview

Financials & Estimates

Ownership

Investor consensus

-1.53%

-23.85%

-20.18%

-16.1%

-13.39%

-27.44%

-33.13%

+40.7%

+16,447.14%

Hexagon is a global provider of technology solutions. The company specializes in the development of information technology that is further used in geospatial and industrial applications. The company's solutions mainly integrate sensors, software, industrial knowledge, and customers' workflows into information ecosystems. Customers are found on a global level in various industries. Hexagon was founded in 1975 and is headquartered in Stockholm, Sweden.

Read moreMarket cap

239.71B SEK

Turnover

155.5M SEK

P/E (adj.) (25e)

18.6

EV/EBIT (adj.) (25e)

15.33

EV/S (25e)

4.43

Dividend yield-% (25e)

1.87 %

Revenue and EBIT-%

Revenue B

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

30.4

2025

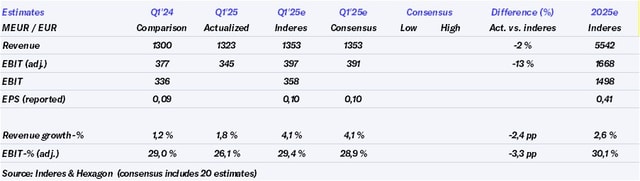

Interim report Q1'25

5.5

2025

General meeting '25

6.5

2025

Annual dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

Hexagon: Fear is a friend to the long-term-oriented investor

Hexagon: Tariffs have burdened sensor sales already in March

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Hexagon announces an update on performance in the first quarter of 2025

Hexagon Q1'25 preview: Diversification and quality to protect against the worst

Hexagon announces leadership changes in its Manufacturing Intelligence division

Notice to the Annual General Meeting in Hexagon AB (publ)

Hexagon completes the acquisitions of the Geomagic software suite and Septentrio NV

Hexagon launches new Robotics division to drive next-generation autonomy

Hexagon publishes the Annual Report and Sustainability Report 2024

Hexagon appoints Gordon Dale as President of its Autonomous Solutions division

Hexagon AB's Nomination Committee proposes the election of Tomas Eliasson as a new member of the Board of Directors

Hexagon: Spin-off plan progressing with expanded scope

Hexagon prepares for the spin-off of its Asset Lifecycle Intelligence division and related businesses

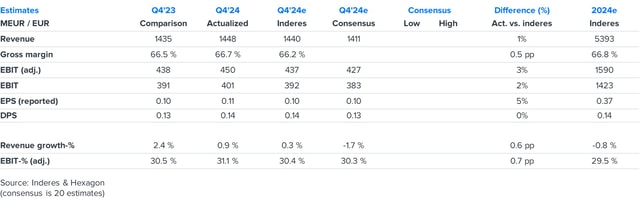

Hexagon Q4'24: Organic growth recovery already priced in

Hexagon Q4’24 flash comment: Profitability and cash flow slightly above expectations

Hexagon Year-End Report 1 January - 31 December 2024