Lindex Group

2.895

EUR

-0.86 %

6,813 following

LINDEX

NASDAQ Helsinki

Personal Goods

Consumer Goods & Services

Overview

Financials & Estimates

Investor consensus

-0.86%

-6.61%

+8.22%

+7.62%

+1.05%

-11.47%

+64.68%

+292.81%

-80.67%

Lindex Group operates in the retail industry. The Group manages a number of stores around larger shopping centers and commercial premises located in the Nordic market. The Group is a reseller of several brands and the range consists of shoes and associated accessories. The company is headquartered in Helsinki.

Read moreMarket cap

468.22M EUR

Turnover

586.17K EUR

P/E (adj.) (24e)

21.14

EV/EBIT (adj.) (24e)

14.96

P/B (24e)

1.18

EV/S (24e)

1.11

Dividend yield-% (24e)

-

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

29.4

2025

Interim report Q1'25

18.7

2025

Interim report Q2'25

24.10

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Lindex Group, Webcast, Q1'25

Lindex Group Oyj: The Board of Directors of Lindex Group plc has resolved on a directed share issue without consideration for the delivery of the long-term incentive scheme rewards

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Lindex Group Oyj: Decisions by Lindex Group plc's Annual General Meeting and the organizational meeting of the Board of Directors

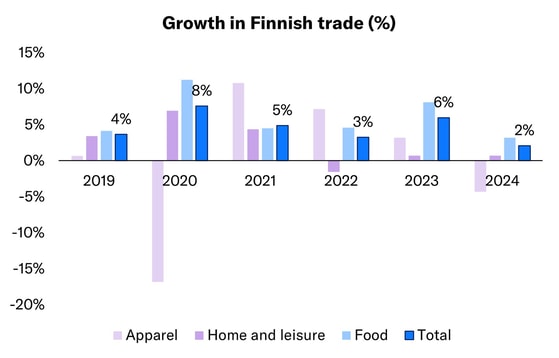

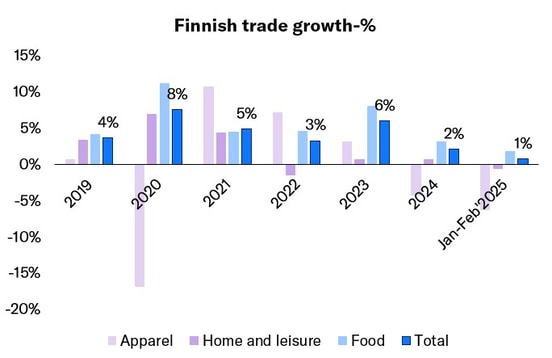

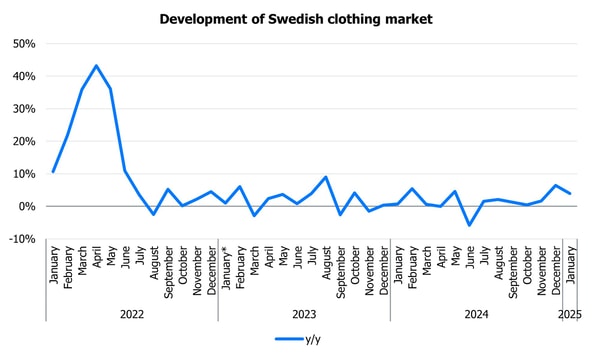

Finnish trade down in February

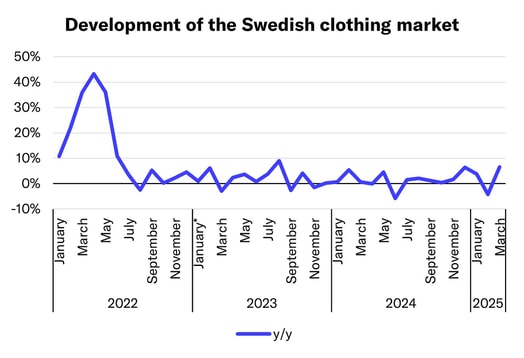

Lindex Group: The Swedish clothing market decreased in February

Lindex Group Oyj: Lindex Group's Annual Report and Remuneration Report for 2024 have been published

Lindex Group Oyj: Share-based long-term incentive scheme for the key management of Lindex Group and its divisions

Lindex Group Oyj: Notice to Lindex Group plc's Annual General Meeting

Growth trend in Finnish trade in January followed last year's pattern

Lindex Group: Swedish clothing market continued to grow in January

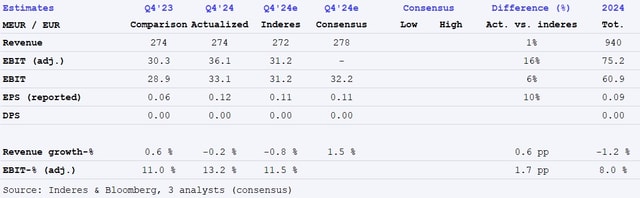

Lindex Q4’24: Still waiting for results from strategic review

Lindex Q4'24: Strong end to the year and positive outlook

Lindex Group Q4’24 flash comment: Strong result and guidance in line with expectations

Lindex Group, Webcast, Q4'24

Lindex Group Oyj: Lindex Group's Financial Statements Bulletin 2024

Lindex Group Oyj: Lindex Group plans to close Stockmann Itis department store in Helsinki

Lindex Q4'24 preview: End of year seems to have gone relatively well