Björn Borg

57.8

SEK

+0.35 %

Less than 1K followers

BORG

NASDAQ Stockholm

Personal Goods

Consumer Goods & Services

Overview

Financials & Estimates

Ownership

Investor consensus

+0.35%

+9.06%

+5.07%

+11.99%

+1.96%

+26.45%

+46.22%

+514.02%

+3,236.76%

Björn Borg operates in the fashion industry and focuses on the design, manufacture and distribution of sportswear and underwear. The company's products are aimed at private individuals looking for comfortable and stylish clothing. The business is global with a main presence in the Nordic region and Europe. Björn Borg was founded in 1984 and is headquartered in Solna.

Read moreMarket cap

1.45B SEK

Turnover

293.15K SEK

P/E (adj.) (25e)

18.1

EV/EBIT (adj.) (25e)

14.07

P/B (25e)

4

EV/S (25e)

1.47

Dividend yield-% (25e)

5.54 %

Coverage

Analyst

Revenue and EBIT-%

Revenue B

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

15.5

2025

General meeting '25

15.5

2025

Interim report Q1'25

16.5

2025

Half year dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

Carnegie Access: Björn Borg: Anticipating maintained fast growth – Q1 preview

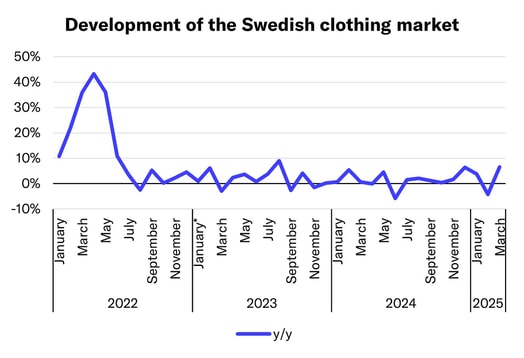

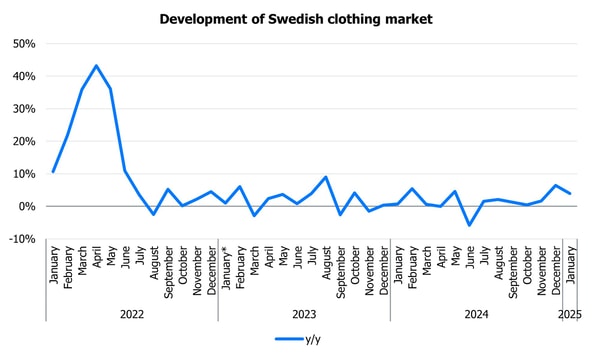

Swedish clothing market grew well in March

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Björn Borg: Risk/reward looks attractive despite uncertainties

Notice of the Annual General Meeting of Björn Borg AB (publ) (”Björn Borg”), May 15, 2025

Björn Borg AB nomination committee proposal for the Annual General Meeting.

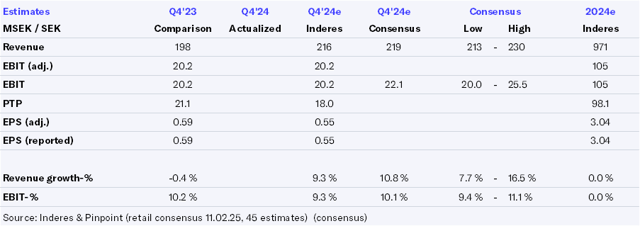

Björn Borg Q4'24: Growth accelerates, but not without trade-offs

Carnegie Access: Björn Borg: Fast growth highlights shoe wear segment potential – Q4 review

Carnegie Access: Björn Borg: Interview– Q4(24) presentation

Carnegie Access: Björn Borg: Strong shoe-driven growth, margins on the soft side

Björn Borg AB, Q4'24

BJÖRN BORG AB YEAREND REPORT JANUARY – DECEMBER 2024

Björn Borg Q4’24 preview: Good growth but shrinking margins

Björn Borg – live presentation February 21st

Lindex Group: Swedish clothing market continued to grow in January

Carnegie Access: Björn Borg: Set to grow at double-digits in 2024

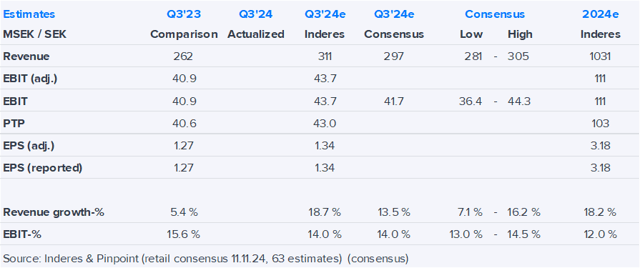

Björn Borg Q3'24: Maintaining a good pace despite challenging conditions

BJÖRN BORG AB INTERIM REPORT JANUARY – SEPTEMBER 2024

Björn Borg – live presentation November 15th