OrderYOYO

OrderYOYO is a Danish Software-as-a-Service (SaaS) company that provides takeaway restaurants with all the necessary software to serve their customers, including online ordering, payment, marketing and business management solutions. The software enables restaurants, primarily within takeaway, to have their own-branded online presence direct to consumers instead of via food portals. In 2022, OrderYOYO merged with German app smart. Going forward, Germany is an important growth market for OrderYOYO. OrderYOYO has a usage-based business model implying that the company grows with its restaurant partners. The company has been listed at Nasdaq First North in Denmark since July 2021.

Read moreLatest research

Latest analysis report

Released: 30.04.2024

OrderYOYO A/S announces request for removal from trading and expected commencement of compulsory redemption of minority shareholders

OrderYOYO A/S announces settlement of the agreement with Pollen Street Capital Limited

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

OrderYOYO A/S: EXTRAORDINARY GENERAL MEETING OF ORDERYOYO A/S

OrderYOYO A/S: Notification of transactions made by persons discharging managerial responsibilities and persons closely associated with them

OrderYOYO A/S announces agreement with Pollen Street Capital Limited to acquire the outstanding shares in OrderYOYO A/S for DKK 9.50 per share

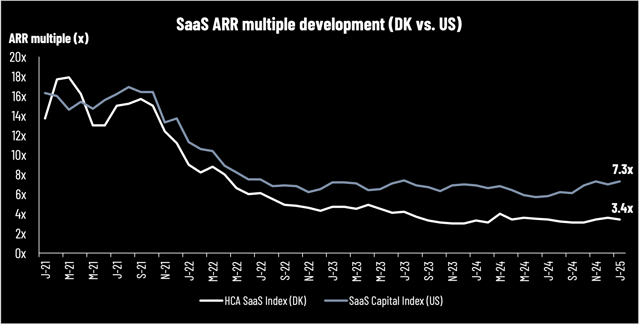

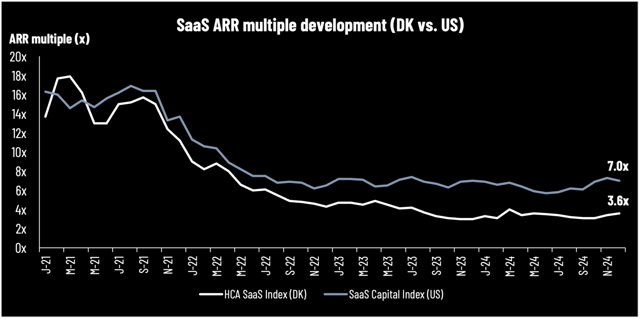

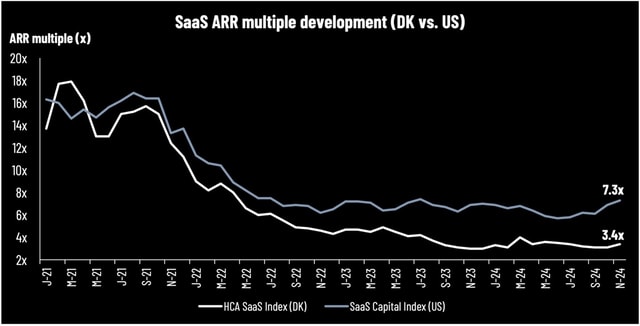

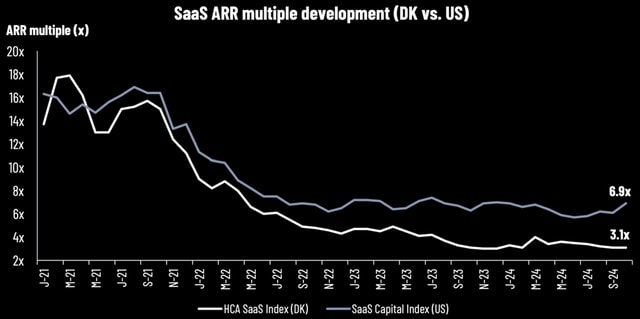

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

Dagens aktienyheder 23/01: OrderYOYO, TORM, Hafnia og DS NORDEN

OrderYOYO - Recording of Q4 2024 presentation

OrderYOYO – Presentation of Q4 2024 trading update

Dagens aktienyheder 22/01: Føroya Banki, OrderYOYO og Curasight

Dagens aktienyheder 20/01: Columbus, OrderYOYO WindowMaster og Impero - Compliance. Simplified.

OrderYOYO A/S: Q4 2024 Current Trading released. 2025 guidance raised

HCA SaaS update December 2024: Year-end update and a look into 2025

HCA SaaS update November 2024: New potential takeover in Denmark and rebound in the US SaaS sector

SaaS HCA update October 2024: First announcements of Q3 2024 reports – more to come in November

OrderYOYO - Recording of Q3 2024 presentation

OrderYOYO – Presentation Q3 2024 trading update