Starbreeze

0.185

SEK

-2.53 %

Less than 1K followers

STAR B

NASDAQ Stockholm

Software

Technology

Overview

Financials & Estimates

Ownership

Investor consensus

-2.53%

+1.37%

-5.13%

-11.74%

-25.76%

-3.34%

-79.15%

-80.34%

-98.28%

Starbreeze operates in the gaming industry and focuses on the development, publishing and distribution of computer games and interactive entertainment. The company's portfolio includes both its own games and collaborations with other game developers. The business is aimed at gamers and distributors globally, with the largest operations in Europe. Starbreeze was founded in 1998 and is headquartered in Stockholm, Sweden.

Read moreMarket cap

273.2M SEK

Turnover

79.68K SEK

P/E (adj.) (25e)

60.39

EV/EBIT (adj.) (25e)

25.16

P/B (25e)

0.38

EV/S (25e)

0.48

Dividend yield-% (25e)

-

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

13.5

2025

Interim report Q1'25

15.5

2025

General meeting '25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Notice of Annual General Meeting in Starbreeze AB (publ)

Starbreeze, Webcast, Q1'25

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Starbreeze AB (publ) postpones publication of Annual Report 2024 until April 15

Starbreeze: New CEO appointed

Adolf Kristjansson appointed as new CEO of Starbreeze

‘Out of Sight’ to be released on May 22, 2025

Roboquest Physical Pre-orders for PlayStation®5 Start Today!

Change in the number of shares and votes in Starbreeze AB

Redeye: Starbreeze - Cash postive agreements with optionality

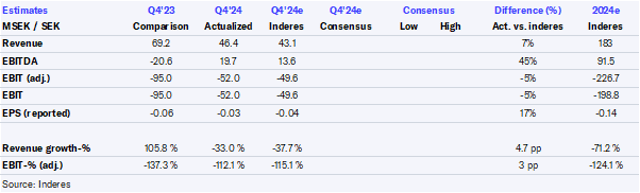

Starbreeze Q4'24: Low expectations presents opportunities

Starbreeze, Webcast, Q4'24

Starbreeze Q4’24 flash comment: PD3 revenue clearly below our expectations

Starbreeze AB (publ) Full-Year 2024

Invitation to investor presentation – Full-year 2024