Gabriel Holding

166

DKK

+5,73 %

Mindre end 1K følgere

GABR

NASDAQ Copenhagen

Home Products

Consumer Goods & Services

Overview

Finansielt overblik og estimater

Investor consensus

+5,73%

+14,48%

0%

-7,78%

-34,13%

-38,06%

-72,1%

-73,44%

-12,63%

Gabriel Holding er aktiv i tekstilindustrien. Virksomheden udvikler, designer og sælger møbelstoffer og beslægtede tjenester. En stor del af forretningen består af services inden for design og konstruktion og derudover leveres forretningssystemer og konsulentydelser inden for produktudvikling. I dag foregår driften globalt med den største koncentration på det europæiske marked. Hovedkontoret ligger i Aalborg.

Læs mereMarkedsværdi

313,74 mio. DKK

Aktieomsætning

114,69 t DKK

P/E (adj.) (25e)

-43,29

EV/EBIT (adj.) (25e)

211,89

P/B (25e)

1,23

EV/S (25e)

0,7

Udbytteafkast, % (25e)

-

Coverage

Omsætning og EBIT-margin

Omsætning mia.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

8.5

2025

Delårsrapport Q2'25

28.8

2025

Delårsrapport Q3'25

20.11

2025

Årsrapport '25

Risiko

Business risk

Valuation risk

Lav

Høj

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

Gabriel Holding: Tariffs lift near-term uncertainty

Gabriel – Præsentation af regnskabet for Q2 2024/25

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Dagens aktienyheder 27/03: Scandinavian Medical Solutions, Gabriel og GreenMobility.

Indberetning af ledende medarbejderes og disses nærtståendes transaktioner med Gabriel Holding A/S’ aktier

Disclosure of transactions in the shares of Gabriel Holding A/S by persons discharging managerial responsibilities and closely related parties

Dagens aktienyheder 21.02.2025: ISS, Gubra, DFDS og Gabriel

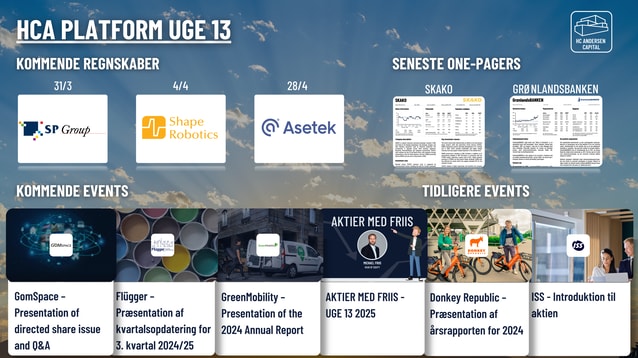

Gabriel- Video med præsentation af regnskabet for 1. kvartal 2024/25

Gabriel Holding Q1'24-25 video: Steady revenues but carve-out uncertainty remains

Gabriel – Præsentation af regnskabet for Q1 2024/25

Dagens aktienyheder 07/02: Danske Bank, Ascelia Pharma, Agillic, Mdundo, Skjern Bank og Gabriel

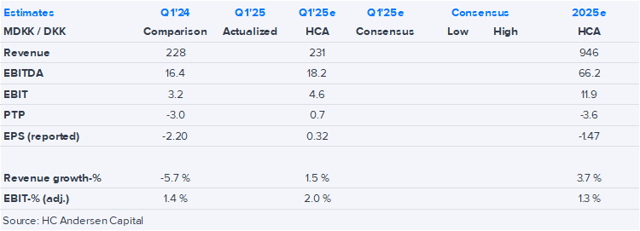

Gabriel Holding Q1'24-25: Q1’24-25 steady but carve-out uncertainty remains

Dagens aktienyheder 04/02: Vestjysk Bank, Agillic, Gabriel og Inderes

Gabriel Holding Q1’24-25 preview: Carve out uncertainty raises near-term risk

Minutes of the annual general meeting on 29 January 2025

Referat fra ordinær generalforsamling den 29. januar 2025

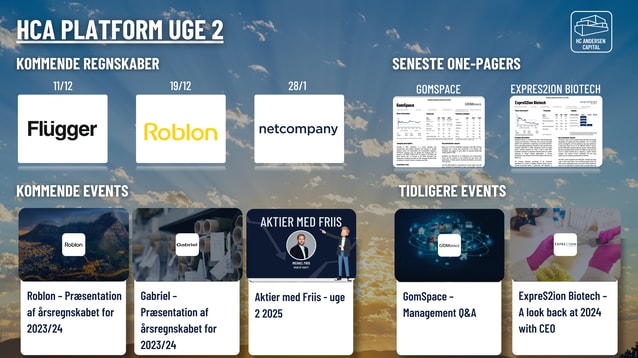

Gabriel- Video med præsentation af årsregnskabet for 2023/24

Gabriel FY'2023/24 video – Waiting for the carve-out to unlock value

Gabriel – Præsentation af årsregnskabet for 2023/24