Ovaro Kiinteistösijoitus

3.11

EUR

-2.2 %

4,278 following

OVARO

NASDAQ Helsinki

Real Estate Management & Development

Real Estate

Overview

Financials & Estimates

-2.2%

-5.18%

-7.99%

-9.06%

-19.22%

-17.51%

-6.04%

-6.04%

-69.81%

Ovaro Kiinteistösijoitus is a company focused on real estate investments and especially real estate development, which mainly buys, develops and sells offices and land areas. Ovaro also owns and rents offices and apartments. The company operates in various parts of Finland, but focuses its operations on Finland's growth centers, i.e. university towns and the capital region.

Read moreMarket cap

26.75M EUR

Turnover

372.44 EUR

P/E (adj.) (25e)

29.83

EV/EBIT (adj.) (25e)

30.84

P/B (25e)

0.56

EV/S (25e)

11.91

Dividend yield-% (25e)

-

Coverage

Analyst

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

24.4

2025

General meeting '25

22.5

2025

Interim report Q1'25

21.8

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

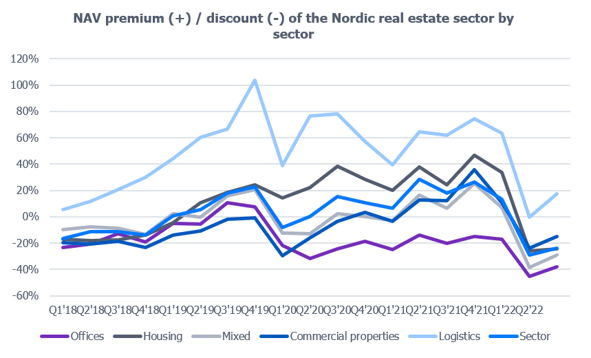

More challenging operating environment reflected in the valuation of the Nordic real estate sector

Ovaron asuntomyynti ja Ydintoiminnan vuokrausaste syyskuussa

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools