Anora Group

3,285

EUR

-0,45 %

5.552 følger denne virksomhed

ANORA

NASDAQ Helsinki

Food & Beverage

Consumer Goods & Services

Overview

Finansielt overblik og estimater

Investor consensus

Anora Group is a producer of alcoholic beverages. The product portfolio consists of wine and spirits marketed under various brands. The largest operations are found in the Nordics and the Baltics, and the company's products are exported to retailers in Europe and North America. The company was created through a merger of Altia and Arcus in 2021 and has its headquarters in Helsinki.

Læs mereMarkedsværdi

221,91 mio. EUR

Aktieomsætning

13,68 t EUR

P/E (adj.) (25e)

11,29

EV/EBIT (adj.) (25e)

7,61

P/B (25e)

0,55

EV/S (25e)

0,48

Udbytteafkast, % (25e)

6,7 %

Omsætning og EBIT-margin

Omsætning mio.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

15.8

2025

Delårsrapport Q2'25

31.10

2025

Delårsrapport Q3'25

11.2

2026

Årsrapport '25

Risiko

Business risk

Valuation risk

Lav

Høj

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

Changes in Anora Group's Executive Management Team: The Head of Anora's Spirits segment to change

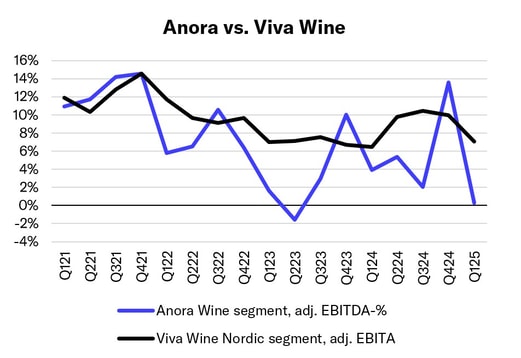

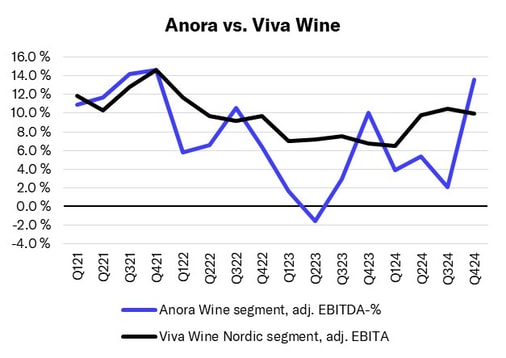

Anora: Main wine competitor Viva Wine reports solid Q1 and acquisition in the Netherlands

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Anora Q1'25: An expected weak start to the year

Anora's financial reporting and Annual General Meeting in 2026

Anora Q1'25: Seasonally quiet quarter even quieter

Anora, Audiocast, Q1'25

Anora Q1'25 flash comment: Easter-despressed quarter close to our expectations

Anora Group Plc's Interim report for 1 January - 31 March 2025: Comparable EBITDA improved in Spirits and Industrial segments, Wine segment impacted by marketing spend

Anora Q1'25 preview: The timing of Easter depresses Q1 figures

Publication of Anora's Interim Report for January-March 2025 on 7 May 2025 and invitation to results presentation

Decisions taken by Anora's Annual General Meeting 2025 and the organisational meeting of the Board of Directors

Anora Extensive Report: Cash flow supports, creating growth a challenge

Anora's Annual Report for 2024 has been published

Anora Group Plc: Notice of the Annual General Meeting 2025

Anora: Kirsi Puntila appointed CEO

Inside information: Kirsi Puntila appointed as new CEO of Anora

Anora: Good growth from Viva Wine, the main competitor in wines, in Q4 as usual

Anora Q4'24: Reasonable cash flow and dividend