Digital Workforce

3,44

EUR

-0,29 %

1.237 følger denne virksomhed

DWF

First North Finland

IT Services

Technology

Overview

Finansielt overblik og estimater

Investor consensus

-0,29%

-8,99%

-12,69%

-14%

-11,34%

+9,21%

-22,88%

-

-45,31%

Digital Workforce is a service provider that specializes in process automation services on an industrial scale. The company's service offering covers the entire life cycle of intelligent automation: design and consulting, development and deployment, cloud-based platform, support and maintenance, and further development. The company offers services and solutions to a wide range of customers in various industries, including finance, healthcare, industry, logistics, and various public actors.

Læs mereMarkedsværdi

38,86 mio. EUR

Aktieomsætning

6,18 t EUR

P/E (adj.) (25e)

15,21

EV/EBIT (adj.) (25e)

12,17

EV/S (25e)

0,81

Udbytteafkast, % (25e)

1,74 %

Omsætning og EBIT-margin

Omsætning mio.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

25.4

2025

Selskabsgennemgang Q1'25

18.7

2025

Delårsrapport Q2'25

23.10

2025

Selskabsgennemgang Q3'25

Risiko

Business risk

Valuation risk

Lav

Høj

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

Resolutions of Digital Workforce Services Plc’s Annual General Meeting 2025

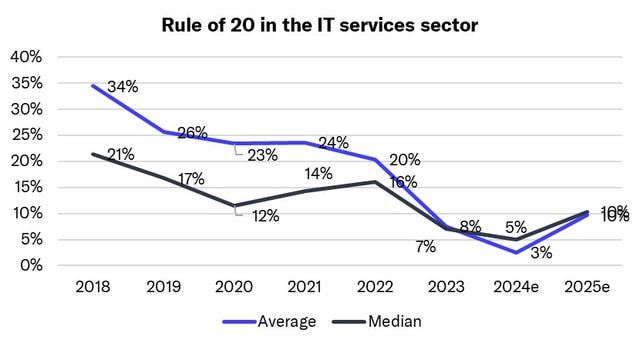

Outlook for the IT service sector 2025: Growth will kick off again at the end of the year

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Change in the Management Team of Digital Workforce Services Plc

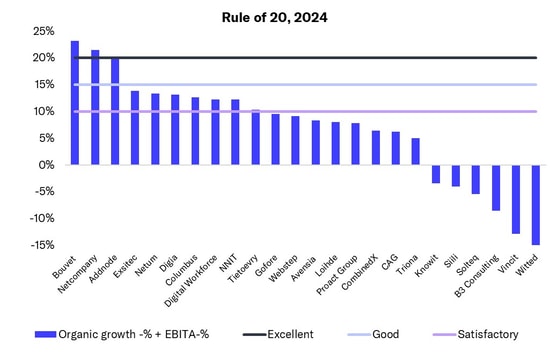

In the IT service sector, a few Nordic companies achieved excellent performance measured by the 'Rule of 20'

Digital Workforce Services Plc’s Financial Statements and annual report for the year 2024 has been published

IT service sector: Q4 was tough, as was 2024

Digital Workforce Services Plc - Managers' transactions - Nieminen

Change in the publication date of the Financial Statements and the Annual Report of Digital Workforce Services Plc for 2024

Notice of the Annual General Meeting of Digital Workforce Services Plc

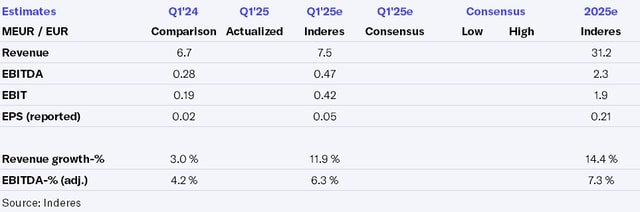

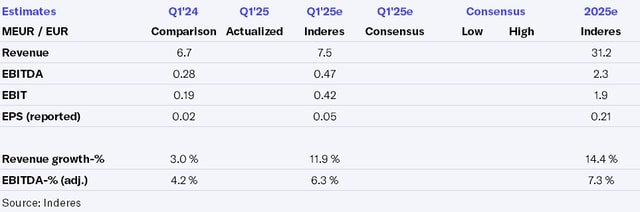

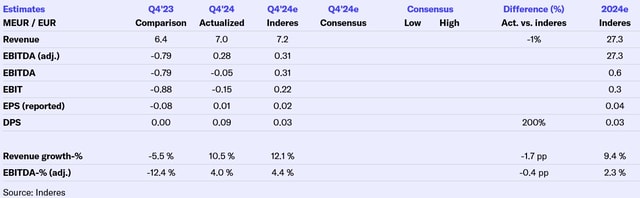

Digital Workforce Q4'24: We expect earnings turnaround to continue

Digital Workforce Q4’24 flash comment: Operationally in line with our expectations and dividend proposal above our forecasts

Digital Workforce Services Plc: Financial Statements Bulletin, January 1 – December 31, 2024: Strong growth in Healthcare sector and Continuous services led to a nearly 10% increase in revenue and a significant improvement in profitability

Share subscriptions based on stock options 2017 and 2020

Digital Workforce Q4’24 preview: We expect guidance indicating earnings growth and a dividend

Digital Workforce Services Plc publishes dividend policy to support the company's profitable growth strategy

Digital Workforce Services Plc - Managers' transactions - Sievilä