Innofactor

1.69

EUR

-0.59 %

IFA1V

NASDAQ Helsinki

Software

Technology

6,022 following

-0.59%

+0.3%

-0.29%

+0.6%

+2.11%

+47.6%

+24.72%

+125.33%

-99.35%

Innofactor operates in the IT sector. The company is focused on offering services in digitization and cloud-based solutions. Examples of business areas include sales, marketing and communication, business intelligence, and CRM (Customer Relationship Management). The largest presence is found in the Nordic market and customers consist of small and medium-sized corporate customers. The head office is located in Espoo.

Read moreMarket cap

60.48M EUR

Turnover

8.19K EUR

Revenue

80.26M

EBIT %

7.28 %

P/E

17.98

Dividend yield-%

-

Financial calendar

28.2

2025

Annual report '24

25.6

2025

General meeting '25

30.9

2025

Interim report Q2'25

ShowingAll content types

Innofactor wins contract to provide the case and document management system for a leading Swedish technical university

Trustee appointed for the arbitration proceedings concerning the redemption of minority shares in Innofactor Plc

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Innofactor: Our coverage ends due to delisting

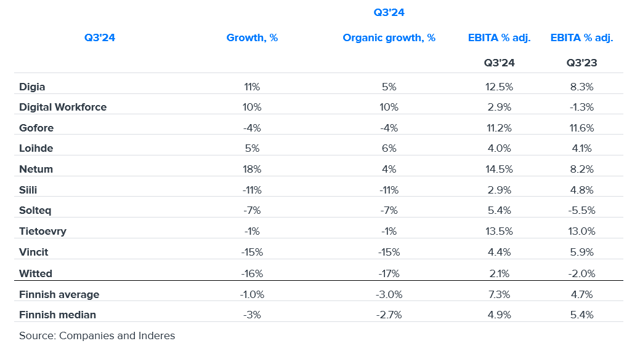

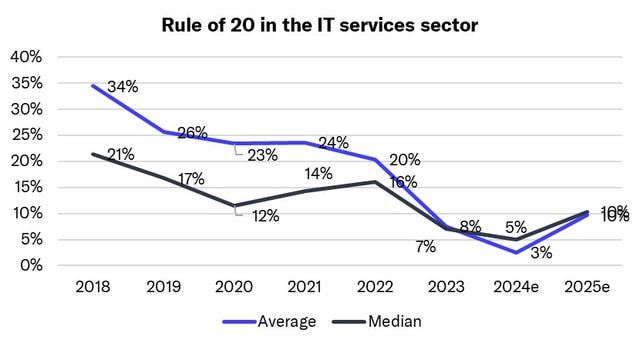

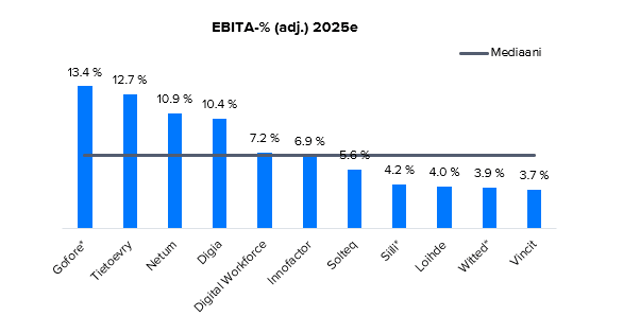

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025

Innofactor Plc: Cancellation of treasury shares registered in the trade register

Change to the date of Innofactor Plc’s Annual General Meeting in 2025

Anni Wahlroos appointed Innofactor’s Deputy CEO

Onni Bidco Oy to commence redemption proceedings in respect of the remaining minority shares in Innofactor Plc