Witted Megacorp

1.29

EUR

+7.5 %

1,479 following

WITTED

First North Finland

IT Services

Technology

Overview

Financials & Estimates

Investor consensus

+7.5%

-6.52%

-18.35%

-14%

-21.82%

-34.02%

-

-

-73.93%

Witted Megacorp is an IT company. The company offers a wide range of consulting services and IT solutions, mainly services related to project and business development. The solutions are used by a number of corporate customers in various sectors. In addition to the main business, various services are offered. The largest business operations are in the Nordic market.

Read moreMarket cap

19.95M EUR

Turnover

49.92K EUR

P/E (adj.) (25e)

17.29

EV/EBIT (adj.) (25e)

9.47

EV/S (25e)

0.22

Dividend yield-% (25e)

1.55 %

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

23.4

2025

Business review Q1'25

29.4

2025

General meeting '25

30.4

2025

Annual dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

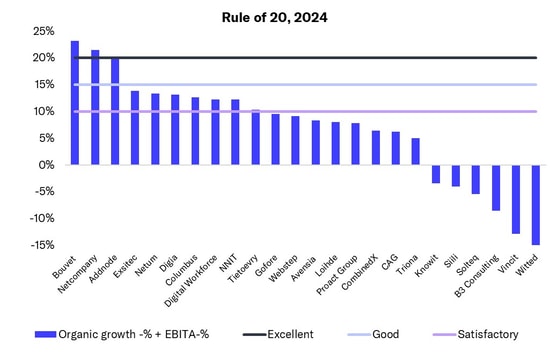

In the IT service sector, a few Nordic companies achieved excellent performance measured by the 'Rule of 20'

IT service sector: Q4 was tough, as was 2024

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

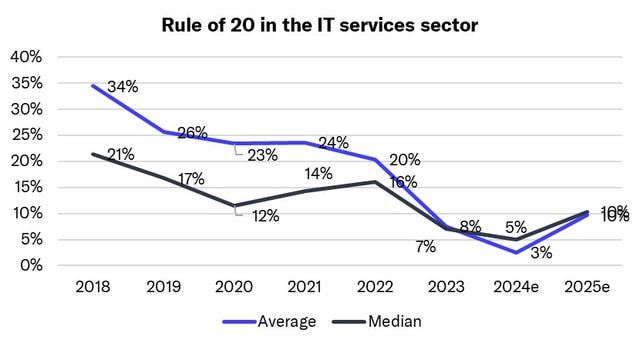

Introducing the Rule of 20: The best measure for IT services performance signals market softening

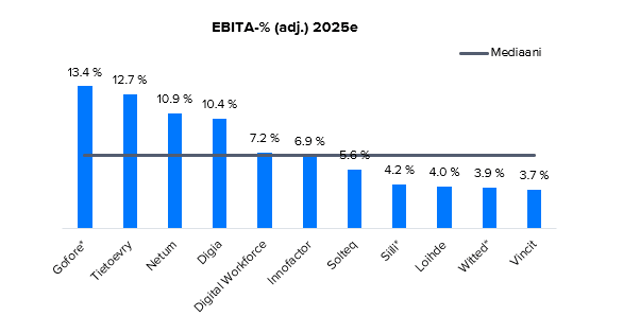

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025

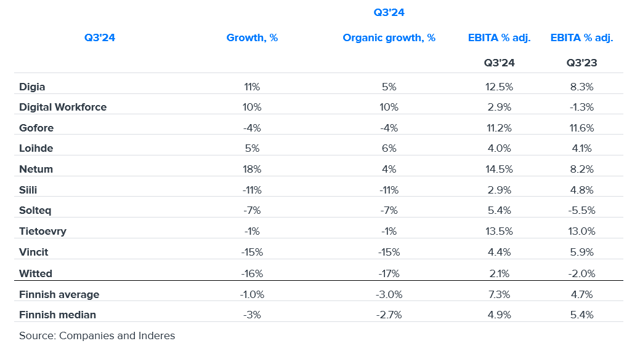

Q3 IT service sector summary: Revenue down but profitability up – sector shows clear divide

IT service sector: Market performance in Denmark and Norway better than in Finland and Sweden

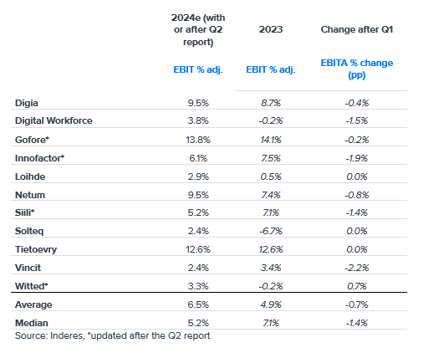

IT services sector 2024 expectations fell slightly in Q2, but H2 looks a little better

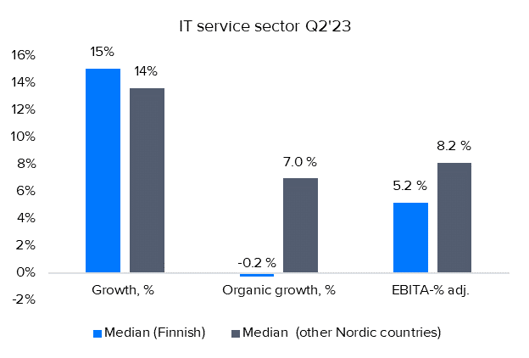

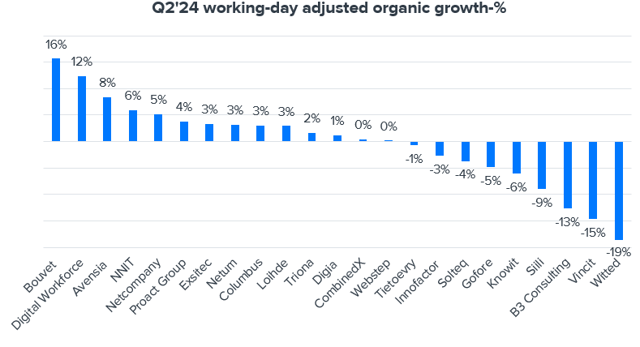

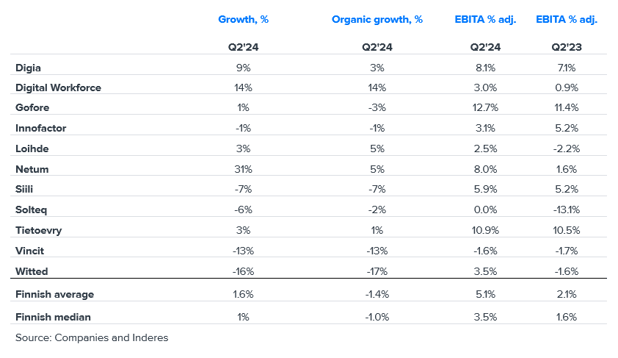

Q2 IT service sector summary: Slightly steeper revenue decline, improved profitability and signs of demand bottoming out

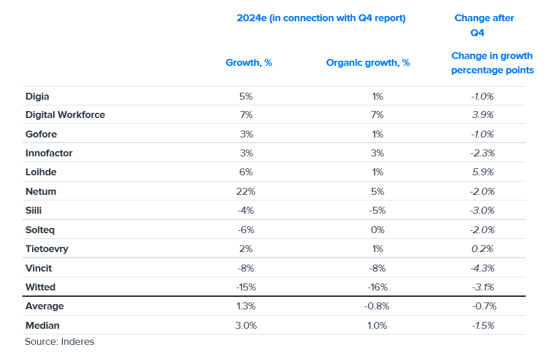

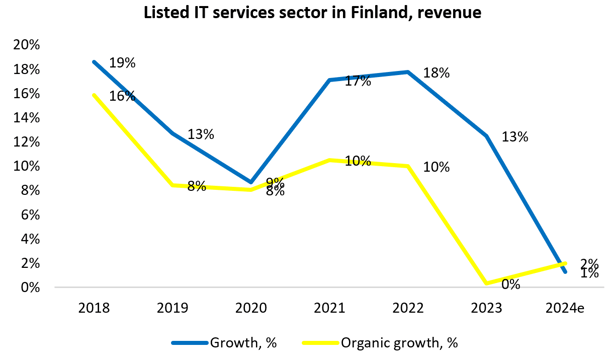

IT services sector's 2024 expectations fell slightly in Q1 - revenue expected to remain flat and profitability to rise slightly

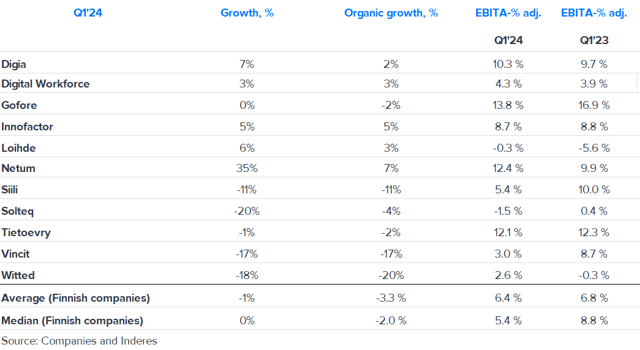

IT service sector Q1 summary: Revenue and profitability down from a strong comparison period, but some defensive wins in profitability as well

IT service sector: Our expectations for 2024 generally at the lower end of companies' guidance

Q4 IT service sector summary: Growth and profitability in line with our expectations, 2023 can be seen as a defensive win

IT service sector valuation levels at the bottom of our 7-year monitoring history, justifiably?

We expect the IT services sector to grow moderately and profitability to increase slightly in 2024

IT services sector Q3 summary: Better than feared with several areas continuing to perform well