Netum Group

2.02

EUR

-1.94 %

1,708 following

NETUM

First North Finland

IT Services

Technology

Overview

Financials & Estimates

Investor consensus

-1.94%

-11.4%

-28.37%

-21.09%

-27.86%

-22.9%

-51.9%

-

-54.61%

Netum operates in the IT sector. The company specializes in the development of software solutions. The software is self-developed and is mainly used for the design and implementation of software, management and monitoring of information systems, cyber security solutions, and for IT management. The customers consist of corporate customers operating in a number of sectors. In addition to the main business, various value-added services are offered. The largest operations are in the Nordic region.

Read moreMarket cap

25.83M EUR

Turnover

8.73K EUR

P/E (adj.) (25e)

13.91

EV/EBIT (adj.) (25e)

8.18

EV/S (25e)

0.69

Dividend yield-% (25e)

5.94 %

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

29.4

2025

Business review Q1'25

19.8

2025

Interim report Q2'25

4.11

2025

Business review Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

3rd party

ShowingAll content types

Change in Netum Group Plc's Management Team – Liisa Rusanen appointed CEO of Studyo Oy and a member of the Group's Management Team

The Board of Directors of Netum Group Plc has resolved to establish a new share-based incentive plan

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

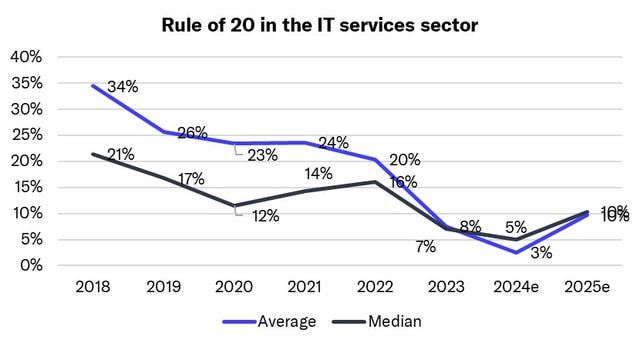

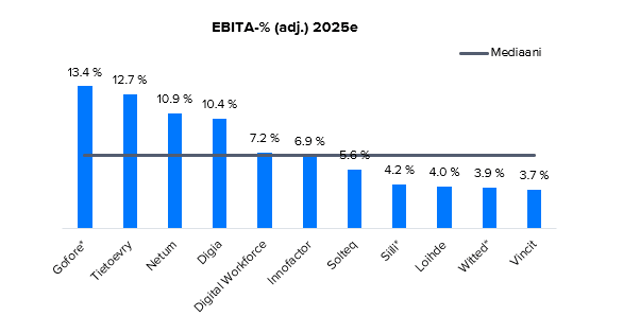

Outlook for the IT service sector 2025: Growth will kick off again at the end of the year

Resolutions of Netum Group Plc's Annual General Meeting and the constitutive meeting of the Board of Directors

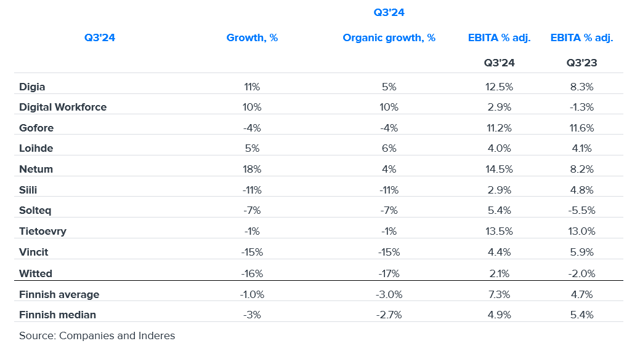

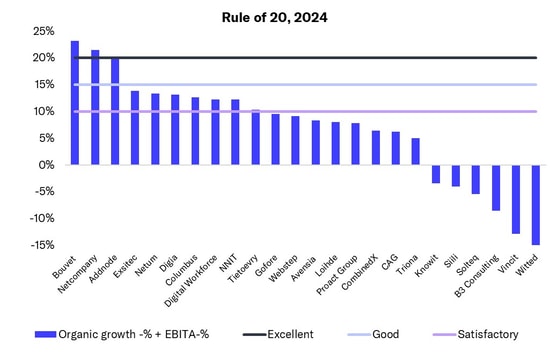

In the IT service sector, a few Nordic companies achieved excellent performance measured by the 'Rule of 20'

IT service sector: Q4 was tough, as was 2024

Netum Group Plc: The CEO of the subsidiary Studyo Oy stepping down

Netum Group Plc: Managers’ transactions – Köngäs

Notice to Netum Group Plc's Annual General Meeting 2025

Netum Group Plc’s Annual report 2024 published

Netum Group Plc’s financial statements release 2024: Significant growth and profitability improvement in 2024 – Q4 at the same level as comparison period

Netum will publish its financial statements release 2024 on Tuesday 25 February 2025

Transfer of Netum Group Plc's own shares for the payment of reward shares of the personnel offering – Change in the number of treasury shares held by the company

Introducing the Rule of 20: The best measure for IT services performance signals market softening

Change in Netum Group Plc's Board of Directors and Management Team – new CEO Repe Harmanen to start in his position on 10 January 2025

Netum Group Plc: Managers’ transactions – Köngäs

Netum Group Plc: Inside information, profit warning: Netum lowers its revenue guidance for 2024 and specifies its guidance on comparable EBITA

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025